Market Information

priceSeries attempts to expose the market manipulation techniques to empower the retail customers so that the financial industry and regulatory bodies can promote a fair and transparent market environment, and reduce the vulnerability of less-experienced traders to fraudulent practices. This knowledge can ultimately contribute to a more resilient and trustworthy financial system.

Market manipulation refers to the intentional and deceptive activities that individuals or entities undertake to artificially influence the price or trading volume of a financial instrument, such as stocks, bonds, commodities, or currencies. The goal of market manipulation is typically to create a false or misleading appearance of market activity, impacting the perception of supply and demand dynamics.

Market manipulation is illegal because it undermines the integrity and fairness of financial markets, erodes investor confidence, and can lead to significant financial losses for unsuspecting market participants.

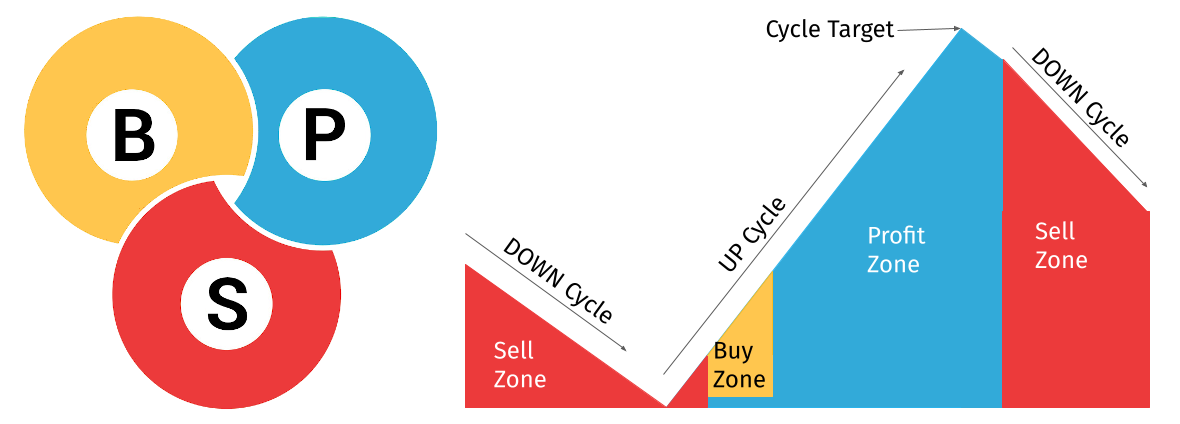

priceSeries recommends the Buy, Profit, and Sell (BPS) trading strategy which is a structured approach for traders to enter, manage, and exit trades based on predefined price levels. This strategy involves three key zones: the Buy zone, Profit zone, and Sell zone, each serving specific purposes in managing trades effectively.

BPS Zones

The Buy, Profit, and Sell (BPS) is a trading strategy provides a structured approach used by traders to enter, manage, and exit trades based on predefined price levels. This strategy involves three key zones: Buy zone, Profit zone, and Sell zone, each serving specific purposes in managing trades effectively.

priceSeries platform analyzes thousands of data points to identify these price zones and help traders make informed decisions accordingly. The strategy allows traders to maintain a structured approach, optimizing trade entries, managing profits, and mitigating potential losses effectively.

priceSeries Solutions Guide

priceSeries Awards